research

[1] The Costs of Hidden Workplace Harassment

Abstract

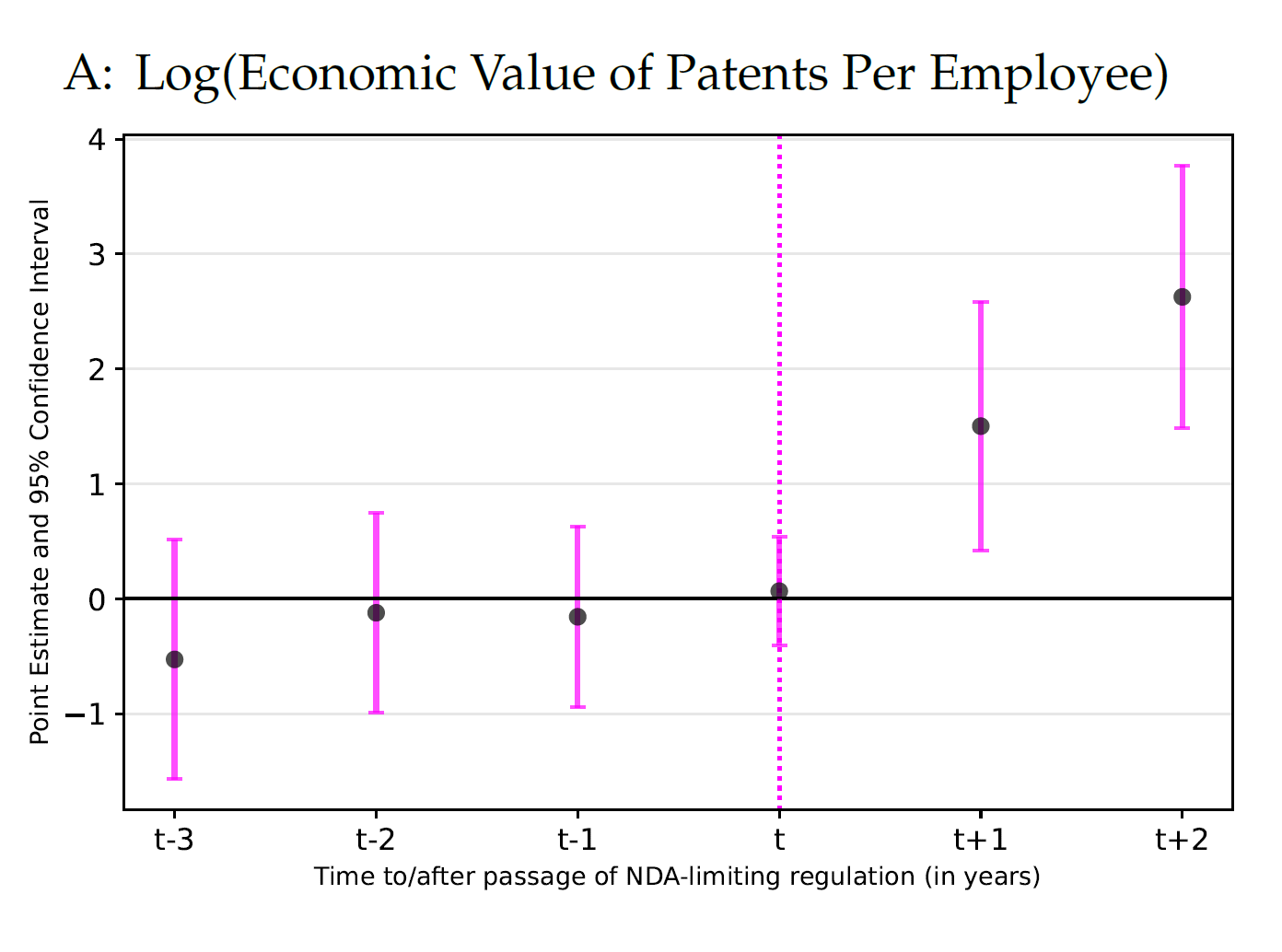

Using natural language processing techniques and millions of anonymous employee reviews, I propose a novel measure of workplace harassment in U.S. firms and investigate its causal effects on innovation and other firm-level outcomes. I exploit the quasi-experimental reduction in workplace harassment caused by changes in non-disclosure agreement (NDA) laws across U.S. states and document a negative impact of workplace harassment on innovation. Firms with previously higher levels of workplace harassment experience a significant increase in their innovation output following these regulations. The documented effect is significantly more pronounced for firms with heterogeneous inventor teams along the gender, race, and ethnicity dimensions. Underlying these effects are improvements in team capital and collaborative dynamics, as the positive changes in the workplace climate lead to significant increases in inventor productivity, as well as retention and entry rates of skilled workers.

Selected Conferences: EFA 2025; NFA 2024; SGF 2024; Colorado Finance Summit 2023

Listen to NotebookLM generated podcast-style summary:

[2] Optimism Shifting, with Stefano Cassella and Chukwuma Dim

Abstract

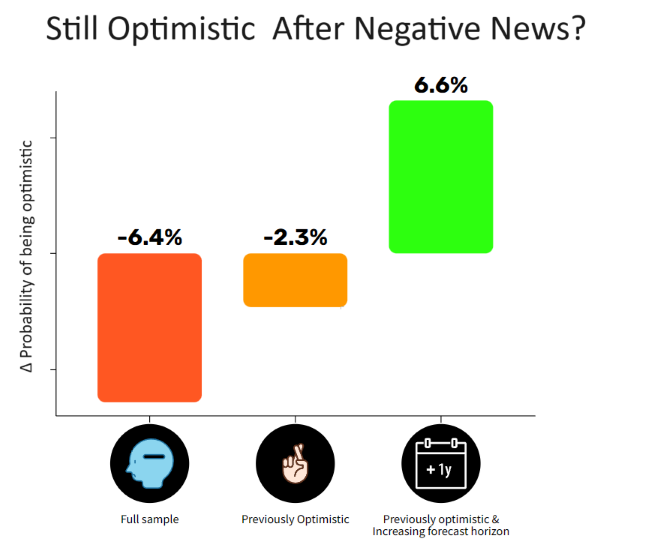

When forecasters are optimistic about the future value of an asset, they react to negative news by engaging in optimism shifting, i.e., they are not only likely to remain optimistic but do so by shifting their optimism to a longer forecast horizon. We document this novel fact about expectation formation and belief updating in a large sample of predictions from CAPS, a social-finance platform. We show that optimism shifting can lead to large underperformance. Our cross-sectional and cross-forecaster analysis indicates that optimism shifting can be due to forecasters’ motivation to retain optimistic beliefs about (i) their skill (a confidence channel); (ii) the value of their financial assets (a physical-stakes channel); (iii) the value of their accrued knowledge about an asset (an intangible-stakes channel)

Best Paper Award in Investments & Asset Pricing, MFA 2024

Selected Conferences: NBER Summer Institute 2024; ESADE Spring Workshop 2024; Bocconi Asset Pricing Conference 2024; MFA 2024; SGF 2024; Foundations of Utility and Risk 2024; Stigler Center Affiliate Fellows Conference 2023 at Chicago Booth